are raffle tickets tax deductible australia

Please use the ACNC. If you would prefer to make a tax-deductible.

Tax Deductible Donations An Eofy Guide Good2give

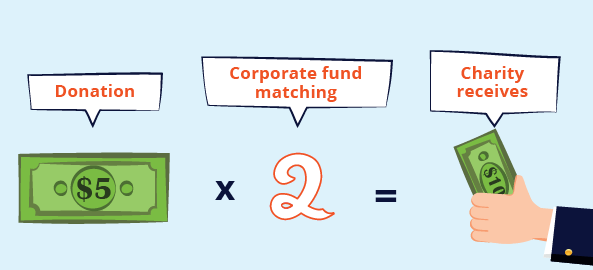

Your gift or donation must be worth 2 or more.

. Give yourself a chance to win big and feel confident that your funds support vital Red Cross work. Raffle tickets are only transferable or assigned to people according to the terms of their ownershipAll raffle tickets are final and no refunds will be made if a mistake was made in salesThe value of raffle tickets purchased does not. Are overseas charity donations tax.

Exceptions for Charity Raffle Donations. Raffle tickets and lottery syndicates. No-one wants to count all the change in all the charity tins but a report in 2018 found the average annual claim for tax deductible donations was 63372.

In accordance with Australian Tax Office guidelines if you receive a lottery ticket in. A material benefit is an item that has a monetary value such as a raffle ticket fundraising chocolate or fundraising dinner ticket. Is A 5050 Raffle Tax-Deductible.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Unfortunately support via our raffle games are not tax deductible. Give yourself a chance to win big and feel confident that your.

This is because the purchase of raffle tickets is not a donation ie. GST and revenue on sale of raffle tickets - not for profit organisation in NSW. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

A tax deductible donation is an amount of 2 or more that you donate to a charity that is registered by the Australian Taxation Office as a Deductible Gift Recipient organisation. Are my lottery tickets tax deductible. However if you want to claim more than 10.

For a donation to be tax deductible it must be made to an organisation endorsed as a Deductible Gift Recipient DGR and must be a genuine gift you cannot receive any benefit from the. 3 donations you can claim on tax. Made to a deductible gift recipient charity and.

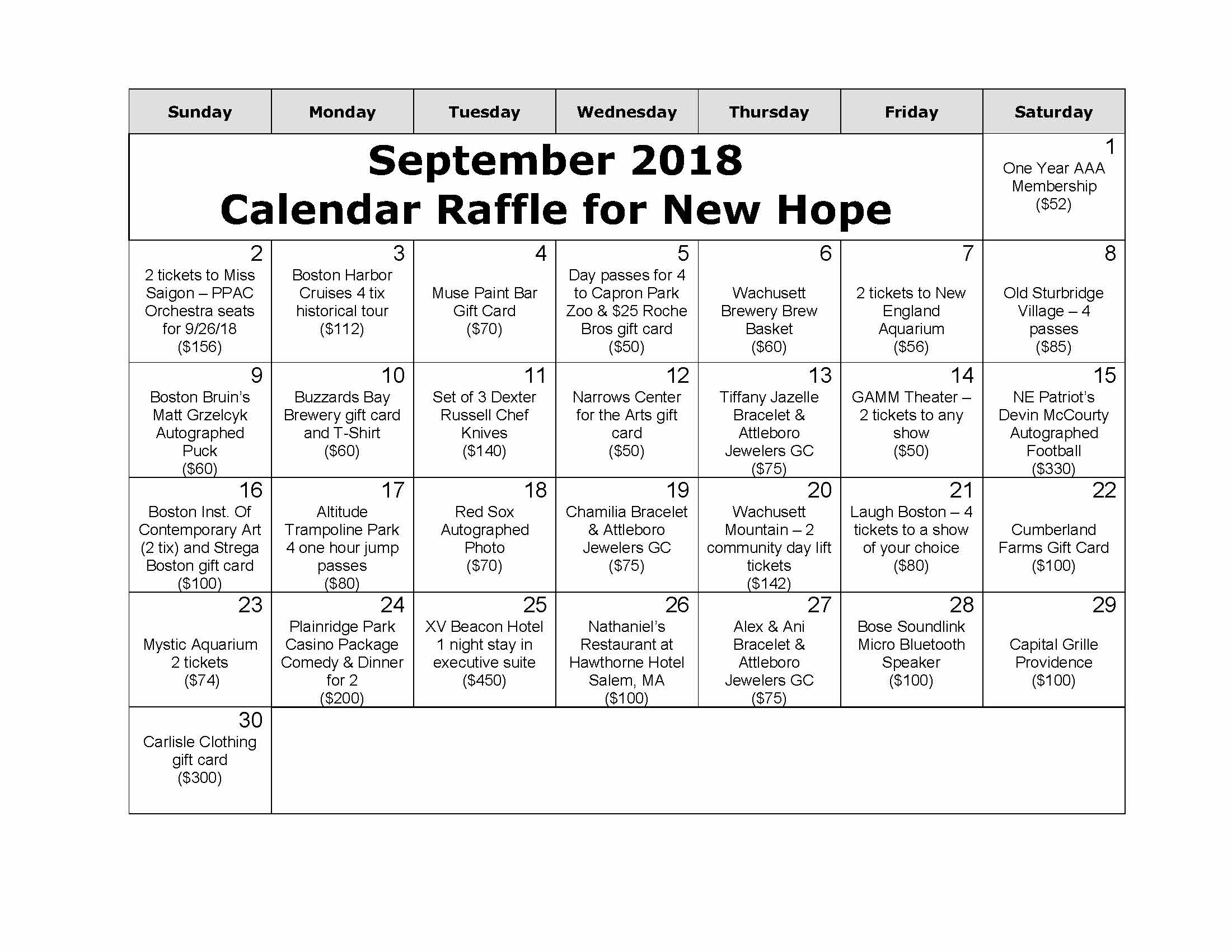

Enter now for your chance to win great prizes. Unfortunately contributing to the monthly office sweep is not a deductible expense and neither are raffle tickets or lottery syndicates. Unfortunately support via our raffle games are not tax deductible.

1500 for contributions and gifts. For specific guidance see this article. Buy a raffle ticket.

The IRS considers a raffle ticket to be a. To qualify for a. You cannot claim a deduction for a purchase for example raffle tickets.

If the gift is property the property must have been purchased 12 months or more before making the donation. There has never been a better time to buy raffle tickets online and enter a Red Cross raffle. Generally you can claim donations to charity on your individual income tax returns.

The only time you can deduct the cost of raffle tickets you purchase from a charity is when you report any type of gambling winnings on. You must also keep proof in the form of a. No lottery tickets are not able to be claimed as a tax deduction.

You can claim up to 10 for coin bucket donations without needing a receipt. Hi I am a bookkeeper for a small not for. To claim tax deductible donations on your tax return your donation must be.

When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their contribution as a tax deduction. There is the chance of winning a prize. There has never been a better time to enter a Red Cross raffle.

In other words charities that sell raffle tickets items or food to raise money cannot benefit from tax-deductible gifts as they are not able to claim these deductions. If you enter a competition and receive a single raffle ticket that is not eligible as a tax-deduction either.

Ato Warns Of Common Tax Deduction 2 In 3 Get Wrong

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Tickets Raffle Auction Fundraiser

Are Raffle Tickets Tax Deductible Raffletix

![]()

Donations And Deductions Bishop Collins

Are Raffle Tickets Tax Deductible Australia Ictsd Org

Letter Requesting Donations For Silent Auction Download This Silent Auction Donation Reques Donation Letter Donation Letter Template Donation Request Letters

Common Tax Issues Associated With Making Donations Wolters Kluwer

Silent Auction Ideas Donation Ideas Its Fun Diy Silent Auction Donations Auction Donations Silent Auction

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Are Charity Auctions Tax Deductible Australia Ictsd Org

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

How To Claim A Tax Deduction On Christmas Gifts And Donations

Tax Deductible Donations An Eofy Guide Good2give

Tax Deductible Donations Reduce Your Income Tax The Smith Family

Southeastern Guide Dogs Gainesville Puppy Raisers Carnival Events In Gainesville And What S Good In Alachua County Fl

How To Know If Your Charitable Donations Are Tax Deductible

Sofii In Memoriam Donation Thank You Letter Samples Donation Thank You Letter Donation Letter Template Thank You Letter Template

Dodgeball For The Arts Enter To Win A 2 Night Stay Plus 100 In Las Vegas Nv Kickball Party Kickball Tournament Dodgeball